Classify Each Item as an Operating Investing or Financing Activity

Then prepare the Statement of Cash Flows for the year ended December 31 2019. Classify each item as an operating investing or financing activity.

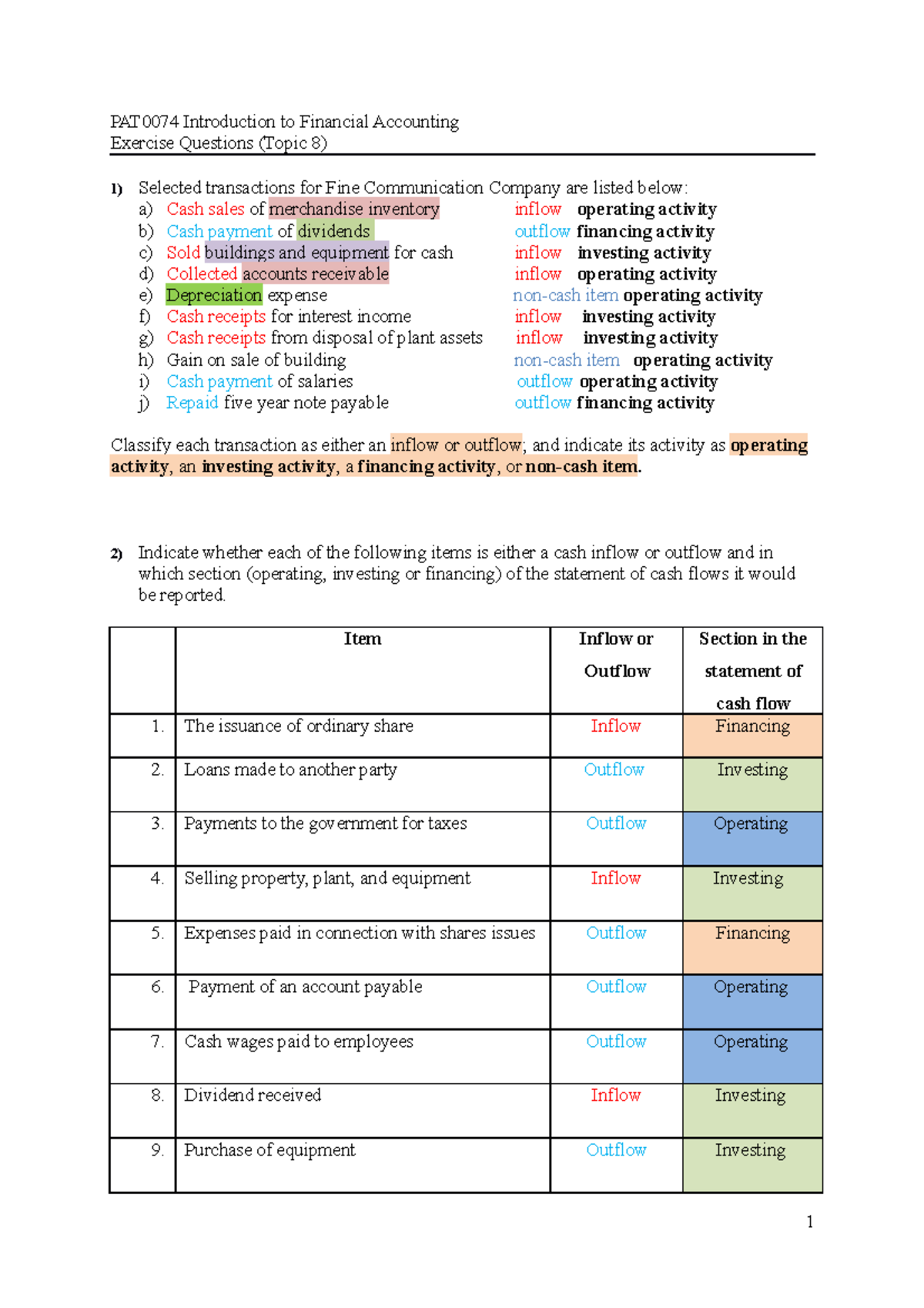

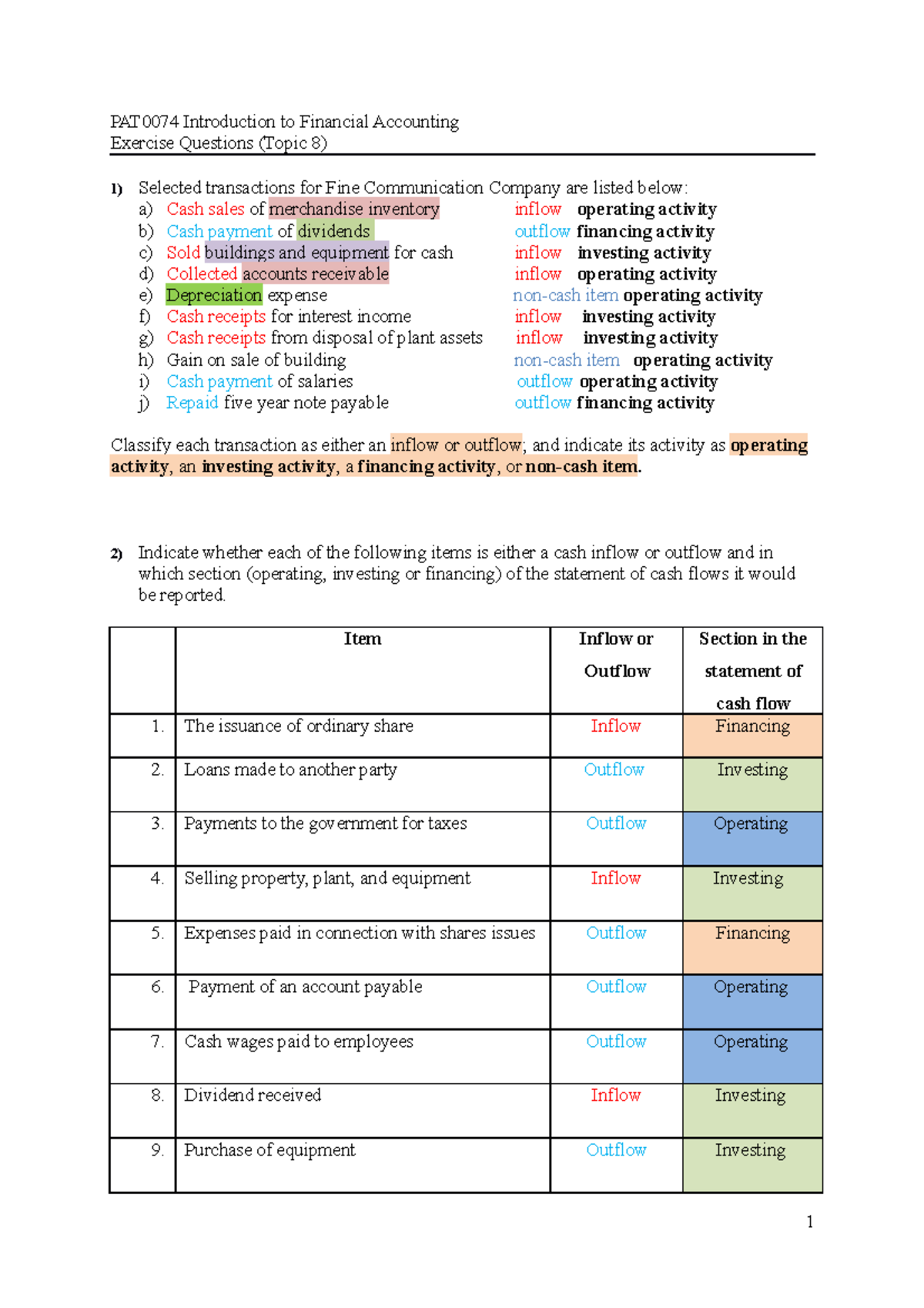

Classify Each Transaction As Either An Inflow Or Outflow And Indicate Its Activity As Operating Studocu

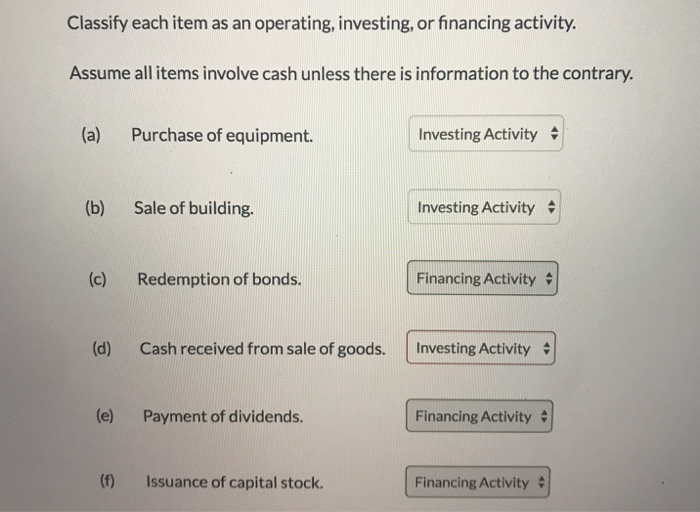

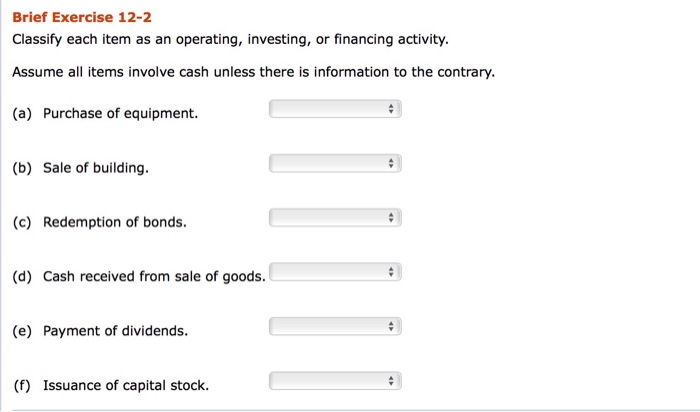

Classify each item as an operating Investing or financing activity.

. The following solution is suggested to handle the subject Classify each item as an operating investing or financing activity. A Purchase of equipment. E Payment of dividends.

Assume all items involve cash unless there is information to the contrary and the indirect method is used. Choose the type of cash flow activity c Redemption of bonds. Assume all items involve cash unless there is information to the contrary.

Classify items by activities. Classify each of the following as an operating activity OA an investing activity IA a financing activity FA or a non-cash flow transaction NT. Amounts are in millions.

Choose the type of cash flow activity d Cash received from. Cash flows from operating activities cash flows from investing activities and cash flows from financing activities. Financial statement users are able to assess a companys strategy and.

12-2 12-3 45 Identify where each of the following items would appear on a cash flow statement under ASPE. F Issuance of capital stock. Classify each item as an operating investing or financing activity.

E Payment of dividends. Question Classify each item as an operating investing or financing activity. Issuance of capital stock.

Identifying Operating Investing and Financing Transactions. B Sale of building. And indicate its activity as operating activity an investing activity a financing activity or non-cash item 2 Indicate whether each of the following items is either a cash inflow or outflow and in.

Classify each cash flow activity Operating Investing Financing or Non-cash. C Redemption of bonds. Classify each item as an operating investing or financing activity.

This information shows both companies generated significant amounts of cash from daily operating activities. Students also viewed these Accounting questions. Assume all items involve cash unless there is information to the contrary.

Choose the type of cash flow activity b Sale of building. Assume all items involve cash unless there is information to the contrary. Financing Activity Operating Activity Investing Activity.

Microsoft Easy Microsoft Corp. A Purchase of equipment. A Purchase of equipment b Sale of building c Redemption of bonds.

4600000000 for The Home Depot and 3900000000 for LowesIt is interesting to note both companies spent significant amounts of cash to acquire property and equipment and long-term investments as reflected in the negative investing activities amounts. Assume all items involve cash unless there is information to the contrary. B Sale of building c Redemption of bonds.

B Proceeds from sale of building. Depreciation expense 40000 Proceeds of Japan bank loan 350000 Cash purchase of building 800000. Talent Fees receivables from clients 500000 Cash receipt from clients 600000.

D Cash received from sale of goods. A Purchase of equipment. Assume all items involve cash unless there is information to the contrary.

Lets keep an eye on the content below. 1Proceeds from issuance of debt. A Purchase of equipment.

Assume all items involve cash unless there is information to the contrary c Redemption paying back when term expires of. Assume all items involve cash unless there is information to the contraryIndicate how each item should be classified in the statement of cash flows indirect method using these four major classifications. Operating activity that is the item would be listed among the adjustments to net income to determine net cash provided by operating activities under the indirect method.

B Sale of building. Classify each item as an operating investing or financing activity. Assume all items involve cash unless there is information to the contrary.

Classify each item as an operating investing or financing activity. View more University Multimedia University Course Introduction to Financial Accounting. Assume all items involve cash unless there is information to the contrary and the indirect method is used.

For example payments to employees would be OA and CO. Classify each transaction as either an inflow or outflow. 6 rows Operating Activity Financing Activity Investing Activity b Proceeds from sale of.

D Cash received from sale of goods. Use O for the operating activities section I for the investing activities section F for the financing activities section NIF for the schedule of noncash investing and financing activities and N if the item does not appear. A Purchase of equipment.

D Cash received from sale of goods. Classify each item as an operating investing or financing activity. C Redemption of bonds.

Classify each item as an operating investing or financing activity. Operating Activity Financing Activity Investing Activity b Proceeds from sale of building. F Issuance of common stock.

3 rows Some cash flows relating to investing or financing activities are classified as operating. Classify each item as involving an operating investing or financing activity. 96 Differentiate between Operating Investing and Financing Activities The statement of cash flows presents sources and uses of cash in three distinct categories.

In addition for each transaction state whether it is a cash inflow CI or cash outflow CO. Reported the following in its annual report to the Securities and Exchange Commission for fiscal year ending June 30 2011.

Solved Classify Each Item As An Operating Investing Or Chegg Com

Solved Brief Exercise 12 2 Classify Each Item As An Chegg Com

Comments

Post a Comment